Jekyll Island, the birthplace of the US Federal Reserve System

If you’re going to make money, you’d better understand how the system works. In 2002, after my third failed business, I decided I needed to get serious about my own financial education and commit to understanding the rules of the game.

In 2007, just as my wife and I were realising our own business success, I read a book by G Edward Griffin called The Creature from Jekyll Island and learned about this place called Jekyll Island, and the creation of the US Federal Reserve system. Reading this lifted the veil off the system, allowed us to understand it, shaping the way we do business which has contributed to our success.

The creation of the Federal Reserve System is an intriguing story, that influence my own actions, so much so that I wrote about it in my own book which was published in 2016, in chapter two of 8 essentials to be a property superstar. Since learning about Jekyll Island, I’ve always wanted to visit, and this week, I made that pilgrimage.

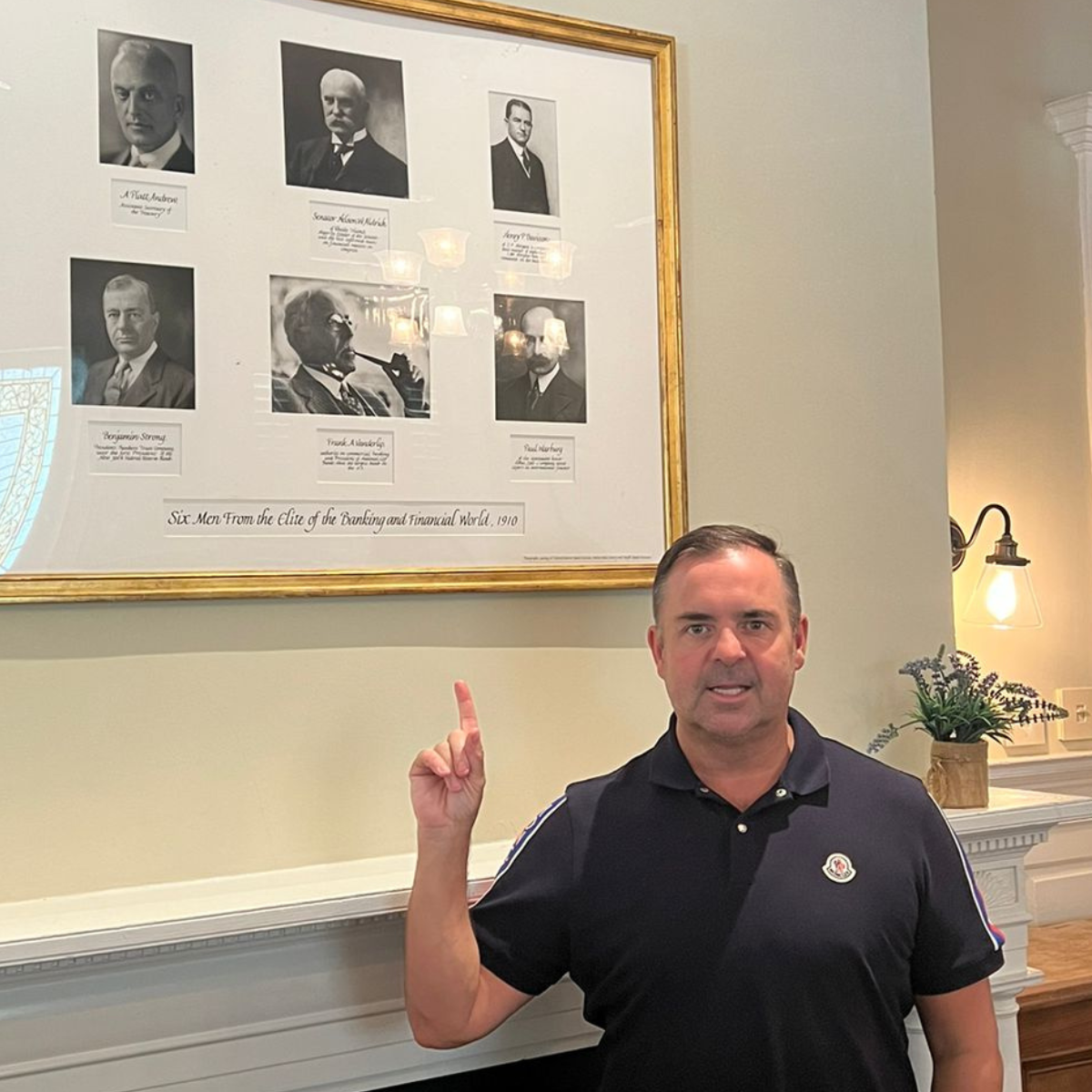

To anyone wanting a better understanding of how the system works, I recommend reading the book or watching G Edward Griffin talk about the Federal Reserve System on YouTube. To cut a long story short…Although the US Federal Reserve System was established in 1913 as the central banking system of the United States of America, the concept was created during a clandestine meeting of six of the World’s most powerful and wealthy men three years prior, in 1910, on a private island off the coast of the state of Georgia. Representing the government, the banking world, and some of the wealthiest families in the World, these six individuals travelled in secret to cook up a ‘system’ by the rich for the rich, that would protect their interests, whilst allowing them to consume more of the World’s influence, power, and wealth than ever before.

On this island, at the Jekyll Island Club, the ultra-exclusive private members club for the US Elite, the group of six including; Nelson Aldrich (a U.S. Senator and the father-in-law of John D. Rockefeller Jr.), Henry P. Davison (a partner at J.P. Morgan & Co.), Paul Warburg (a prominent banker with ties to the move established European banking sector), A. Piatt Andrew (Assistant Secretary of the Treasury), Frank Vanderlip (President of National City Bank of New York), came together to draft legislation that would become the Federal Reserve Act. At this secret meeting, the six individuals owned or represented one quarter of the World’s wealth at that time. They already had power and wealth, and they weren’t about to devise a system to jeopardise their position.

The supposed role of the Federal Reserve System and central banks

When the Federal Reserve Act was signed into law by President Woodrow Wilson in December 1913, the powers that be claimed it would stabilise the US economy, which had previously experienced periods of financial panic and banking crisis, and would evenly distribute power away from the few to the many, although the primary focus of those creating the system was to snatch more power and wealth. This newly incorporated central bank system had (and still has) the powers to regulate money supply, set interest rates, and act as a lender of last resort to financial institutions.

Good or bad, the Federal Reserve System is the system, and I’d rather understand it so I can work it to my benefit than stand on the sidelines, or worse, be oblivious to it.

You don’t need to like the system, but you’ve no choice but to operate within it

When you understand that money is only created by borrowing, you’ll begin to understand the role of a central bank. The Creature from Jekyll Island was written by G Edward Griffin in 1994 as an exposé of the Federal Reserve System, revealing the reality of the organisation as a self-serving cartel, that we should vote to abolish. I’m not an idealist like Griffin, I’m a pragmatist who learns how to work within the system for maximum benefit, and understanding how the system works has been critical to our success, where my previous lack of understanding undoubtedly lead to my business failures.

Griffin outlines what he calls the Mandrake Mechanism, the concept of how money is created out of nothing and moves around the system. The basics are that money is debt, it is created through borrowing, and removed when debt is paid back, so really you’re doing your country a disservice by not borrowing money. If you fully understand this, you’ll know more than 98% of the population.

So the game is rigged in favour of the banks and the powers behind them. Rather than get upset about the system, I’d much rather spend my energy working within the system, to my benefit. I’m not bothered about what someone else gets, I’m only interested in myself and don’t spend energy worrying about anyone else.

Taking your money without you evening knowing it

The modern economic system relies on central banking influence, and this was clearly demonstrated during the Coronavirus Crisis, where the US injected a phenomenal $13 trillion into the system by means of quantitative easing. With over 60% of US GDP injected into the system over a short period of time, the value of the US Dollar (much like all main currencies around the World) declined, manifesting as an increase in inflation which is then controlled by increasing interest rates, controlled by the Federal Reserve System. Whilst this injection of cash paid for Covid stimulus packages that kept people in jobs and more businesses from failing, don’t fall into the trap of thinking there’s anything charitable afoot.

The rules of central banks allow control over the real-time value of currency, which means, they can steal money out of your pocket, without you even knowing it. By pumping money into the system, the value of the currency falls, meaning the purchasing power of the cash in your pocket reduces, don’t be fooled into believing inflation means goods are getting more expensive, they’re not, it’s just your money doesn’t go as far.

Regardless of your opinion on the morality of it all, the power of Federal Reserve system is incredible, and the story behind its creation even more so. Under cloak and dagger, six individuals created the system which under pins the entire US economy today, and protects their interest, and that of their wealthy friends. My commitment to financial education led me to visiting Jekyll Island, and the Jekyll Island Club, with my family, where we’ve seen where the system was created. A system, where our personal success relies on our understanding of it. By learning about debt, and leverage, we have been able to work within the system, for our own benefit and gain.

And it’s not just the Federal Reserve System, all central banks operate in the same way and they, and the monetary rules they implements are there to protect the wealthiest and the government. However, the story of the formation of the US Federal Reserve System lifts the veil of the reality of the system and I’d rather learn about it, learn the rules, and use the knowledge to my own advantage.